- Home News & Press Tips and Tricks Blog

- Market Update in the Wake of Coronavirus

Tips and Tricks Blog

Market Update in the Wake of Coronavirus

We understand the need to communicate with our clients during a volatile time…With despair comes opportunity. Markets have fallen significantly since the arrival of COVID-19. And yet, this black swan event exemplifies our use of asset allocation as a means of mitigating risk for our clients.

Clients who are not yet retired should understand that time is on their side. Clients who are close to, or in retirement should take comfort in knowing that a significant portion of their portfolios are in fixed income, which has performed well during the equity selloff. Any cash needs can be satisfied from fixed income without disrupting equities, allowing equities the chance to rebound over time.

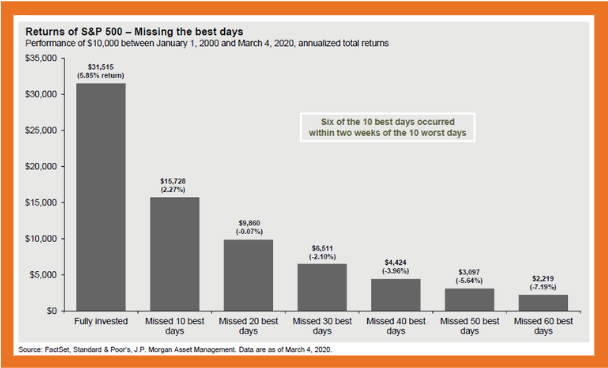

Despite the price action this week, the market seems to still be searching for a bottom. Bottoms typically form over several months, not weeks. Throughout this process, it’s important to remember that volatility is a two-way street. Often, large down days are followed by large up days. This is why trying to time the market can have such dire consequences to a portfolio in the long run.

At CORA Capital Advisors, we still see this market event as very different from the financial crisis we faced in 2008-2009. Banks are solvent and liquidity is being injected by the FED. We also expect the government to support the markets and economy with a fiscal stimulus. Our banking system was recapitalized post 2009 and is in a much better position to handle an economic shock.

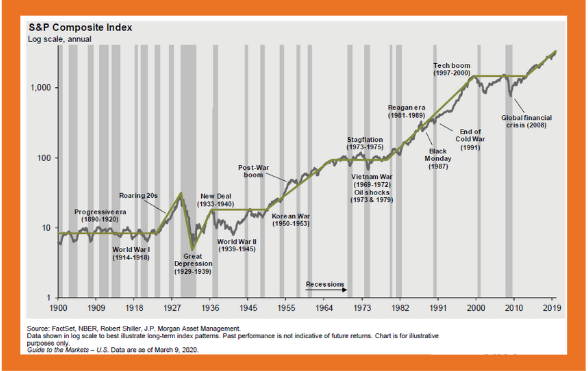

While business is slowing down, and we may end up in a recession, we believe it could be very short-lived once the virus has peaked and panic begins to dissipate along with it. See historic evidence of this below.

At this point in time, we are looking for financial planning and investment opportunities. We are reviewing non-qualified accounts for tax-loss harvesting. Mortgage rates are at historic lows. Roth conversions can be done at a significant discount. We are looking to invest in great business at great prices. By default, the moments of best opportunity coincide with maximum despair. If you are wondering about specifics, these are points for consideration.

I. Revisit your financial plans

- Review your liquidity needs over the next 12 to 18 months

- Consider refinancing your mortgage, student loans and high-interest debt

- Ensure adequate insurance for family regardless of employment status

- Put your tax refund to work and invest rather than paying off low-interest debt

II. Revisit your investment and insurance policy statements

- Align your investments with your risk tolerance and liquidity requirements

- Allocate your investments to tax-effective account types

- Consider tax-loss harvesting, Roth conversions and contributions

- Review your policy riders, conversion options and beneficiaries

Please call us if you have any questions, we are here for you or those you think we should speak with in order to maximize the potential opportunities outlined above. Thank you.

Investment advisory and financial planning services offered through American Portfolio Advisors, Inc., an SEC Registered Investment Advisor. Cora Capital Advisors are unaffiliated entities of APFS and APA. Securities offered through American Portfolios Financial Services, Inc. Member FINRA/SIPC. Information has been obtained from sources believed to be reliable and are subject to change without notification. The information presented is provided for informational purposes only and not to be construed as a recommendation or solicitation. Investors must make their own determination as to the appropriateness of an investment or strategy based on their specific investment objectives, financial status and risk tolerance. Past performance is not an indication of future results. Investments involve risk and the possible loss of principal.

Contributor: Kelly-Anne Shoaf